Scriptly Helps Pharmacies Identify Trends in Real Time with Reveal

The insurance business has always been competitive – now more than ever. Every insurance provider has a wealth of data, but only the ones that use that data and turn it into useful insights for their advantage can get ahead of the pack. Insurance analytics helps identify profitable customers and manage their entire lifecycle from acquisition to maturity.

Watch a Demo BOOK A PERSONALIZED DEMO Request a Demo FREE TRIAL

From determining risk on an individual level to optimizing marketing and sales strategies and effectively preventing fraudulent claims, insurance analytics are central to the success of insurance companies and their competitive advantage. Data is the lifeblood of the insurance industry and in the age of BI and AI, insurance companies that are leveraging analytics and integrating insights into their business processes and strategies are simultaneously increasing customer satisfaction and profits.

Using data insights helps insurance providers to deep dive into understanding the process customers use to make decisions and their customer behavior. They can then use that knowledge gathered to better target and generate leads and identify the best up-sell and cross-sell market opportunities. Insights also help insurances personalize their offerings and messages to reach their lead generation goals faster.

One of the biggest benefits of data analytics in any industry, but specifically in insurance, is that it can easily help prevent fraudulent insurance claims. Based on applicants’ past behavior, insurance companies can process any claim and detect if given trends in past frauds are repeating and therefore prevent the occurrence of such.

Insurance analytics allows you to easily calculate how much risk is associated with each insurance application before issuing a policy. Data can tell you whether the individual applying for a policy has any police crime records and whether it is a risk customer. When you know that, you can make a better decision on whether it’s worth it or not to issue a policy to that individual.

Insurance analytics allows you to optimize operational processes by automating repetitive tasks such as compliance checks. This makes insurance companies’ processes more efficient and reduces the costs associated with handling claims manually and administratively.

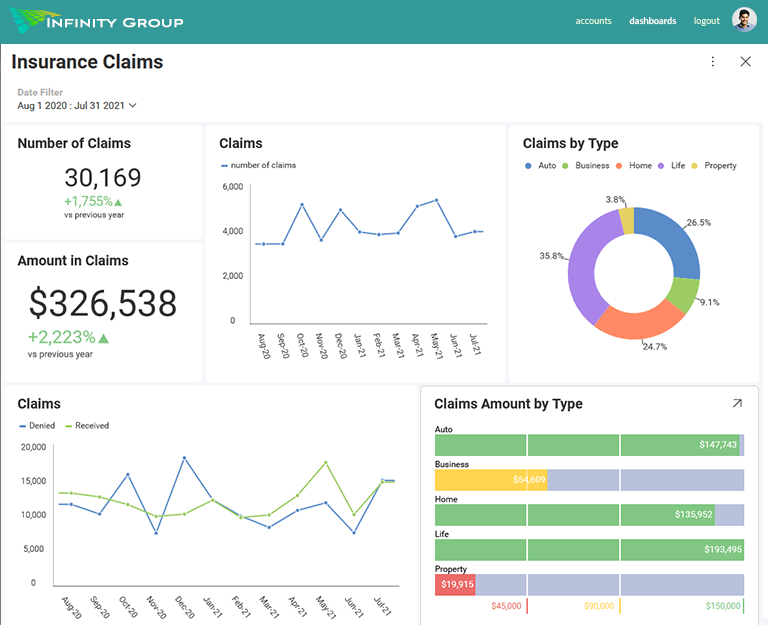

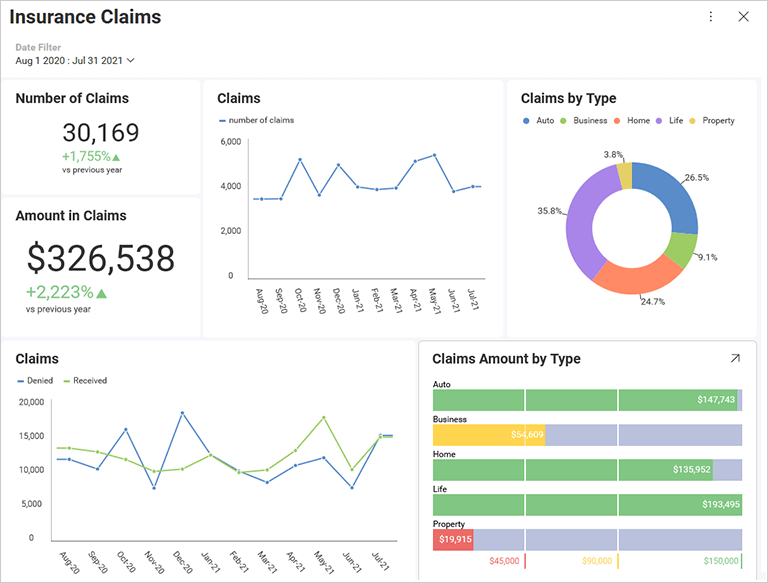

Insurance dashboards are used to track and monitor key insurance metrics and KPIs to gain deeper insights and understanding into the overall insurance company performance.

Get an overview of your company’s insurance claim metrics and answers to questions like how many claims you have received this month, how does the number compare to previous months, and what is their average cost, etc.

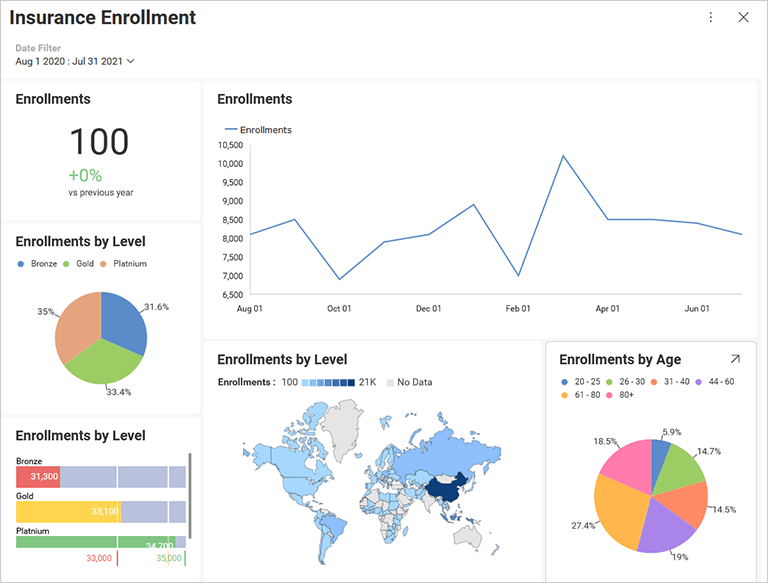

This dashboard allows insurance professionals to track and monitor demographics of the customer base, patterns for enrollment, revenue gain over a specific period of time, and other key enrollment KPIs.

Embedded insurance analytics integrates data analysis capabilities directly into insurance systems and applications, enabling real-time data access and data-driven decision-making.

Embedded analytics in insurance help manage customers’ lifecycle from acquisition to maturity, optimize marketing and sales strategies, prevent fraudulent claims, and predict risks associated with insurance applications. By leveraging real-time insights, insurance companies can personalize offerings, target leads more effectively, and, ultimately, streamline operational processes to reduce costs and improve profitability.

Insurance analytics software helps insurance companies harness data to meet customer needs, predict risks and more. It brings powerful data analytics tools in the hands of the decision makers so they can view performance in real time and act accordingly.

It sure is. Reveal’s powerful data analytics functionalities can benefit life insurance companies, social insurance companies, property insurance companies, car insurance companies, travel insurance companies, and others. There is no limit to the types of insurance companies that can use and benefit from Reveal.

Back to Top