製品としての分析: 埋め込みインサイトを収益に変える方法

SaaS リーダーは、差別化、収益拡大、顧客エンゲージメントの維持というプレッシャーに直面しています。製品分析は、3 つすべてを実行するための直接的な道を提供します。自社製品に洞察を組み込むことで、企業はプレミアム機能層を作成し、分析をアドオンとして販売し、日常的な依存を通じて維持率を高めることができます。顧客は現在、エクスペリエンスの一部として、セルフサービス、ブランド化、インテリジェントなダッシュボードを期待しています。これらの期待に応えるには、SDK ファーストの統合、カスタムブランディング、スケーラブルな価格設定、データへの信頼できる接続が必要です。Revealのようなプラットフォームを使用すると、製品チームは分析を製品内に埋め込み、コストセンターから収益エンジンに変えることができます。

エグゼクティブサマリー:

キー・テイクアウェイ:

- 製品分析は成長の原動力です: プレミアム階層、アドオン、リテンションを通じてインサイトを収益化します。

- 顧客の期待は変化しました:ユーザーは、製品内でセルフサービス、シームレス、インテリジェントな分析を求めています。

- 収益を可能にする機能: SDK ファーストの統合、ホワイトラベル分析、データソースへの接続は収益化モデルをサポートします。

- 組み込み分析はエンタープライズBIを上回るパフォーマンス:レガシーと最新の組み込み分析は、製品ネイティブのアプローチのみが成長を促進することを証明しています。

- ケーススタディの証拠:Avionは開発期間を1年間短縮し、収益化可能な機能をより迅速にリリースし、リテンションを強化しました。

- Reveal製品としての分析を可能にします:SDKファースト、スケーラブルな価格設定、ブランド管理により、SaaSチームは収益成長を促進するデータ駆動型製品を設計できます。

分析はコストセンターとして扱われることが多すぎます。しかし、製品分析は、SaaSビジネスにおける最も強力な収益原動力の1つになる可能性があります。実際、31.4%の組織は、より高い収益を生み出すためにすでに組み込み分析を使用しています。

インサイトが顧客向け機能としてパッケージ化されると、新しい価格帯が作成され、顧客維持率が向上し、競争力のある差別化がもたらされます。この変化を実現する最も早い方法は、組み込み分析を使用することです。ダッシュボード、レポート、予測機能が製品に統合されると、それらはアドオンではなくなり、顧客が料金を支払う製品機能のように機能し始めます。

これを理解するには、SaaSプロバイダーが組み込みの洞察を収益に変換する主な方法を調べる必要があります。

組み込みのインサイトを収益に変える

分析を成長の原動力にする最も明確な方法は、分析をサポート機能ではなく製品として扱うことです。企業は、顧客が見て評価する製品分析を通じて新しい収益源を生み出すことでこれを実現します。

プレミアム機能層

分析は、多くの場合、エンタープライズまたはプロレベルのプランを固定します。ダッシュボード、予測モデル、高度なエクスポートは、アップグレードの理由になります。

- 企業の購入者は、上位レベルの価格設定の一部として分析を期待しています。

- 顧客は、インサイトが結果に直接結びつく場合、追加コストを正当化します。

- 分析が測定可能なビジネス価値を示すと、アップセルが容易になります。

アドオンまたは使用量ベースの価格設定

一部の企業は、分析をモジュールとして扱います。役割や使用状況によって測定する人もいます。どちらの場合も、分析は測定可能なサービスになります。

- アドオンを使用すると、すべての顧客に支払いを強制することなく、モジュール式の価格設定が可能になります。

- 使用量ベースのモデルは、顧客の需要に応じて拡張され、ARR が拡張されます。

- これらのアプローチは、データ収益化に関するより広範な戦略と一致しています。

保持力と粘着性

収益は、顧客を長期間維持することでも得られます。分析は習慣を身につけ、製品の交換を困難にします。

- インサイトは、製品の信頼性を強化する日々のタッチポイントを作成します。

- 保持は生涯価値を高め、チャーン圧力を軽減します。

- ダッシュボードが組み込まれているため、顧客は他の場所でソリューションを探す必要がなくなります。

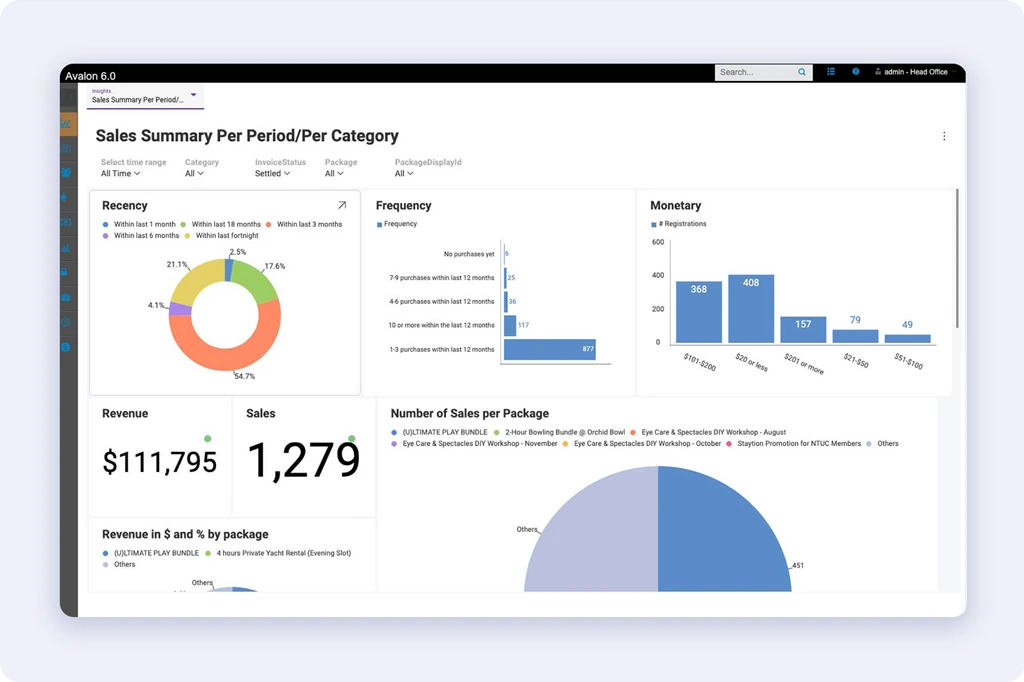

アビオンの経験は、その影響を示しています。分析を構築するのではなく、分析を組み込むことで、開発にかかる時間を 12 か月節約しました。この加速により、収益化可能な機能をより早くリリースし、コア製品にリソースを再投資することができます。

業界データによって価値が確認されます。大規模なデータと分析は、製品全体に組み込まれた場合、年間9兆5,000億ドルから15兆4,000億ドルの価値を生み出す可能性があります。

収益モデルは機会を創出しますが、成功は顧客の期待に応えるかどうかにかかっています。

ユーザーが製品分析に期待すること

分析に対する顧客の期待は変化しました。静的なレポートではもはや十分ではありません。現在、ユーザーは製品分析を二次的な機能ではなく、コアエクスペリエンスの一部として見ています。

まず、セルフサービスを期待しています。ビジネス ユーザーは、エンジニアリング チームを待たずに、データの探索、フィルターの適用、ダッシュボードの作成を望んでいます。セルフサービス BI は、摩擦を軽減し、導入を促進し、開発者の負担を軽減します。

第二に、ユーザーはシームレスな統合を期待しています。分析は、製品の他の部分と同じように見え、感じられる必要があります。ダッシュボードがボルトで固定されているように見えると、信頼と使用率が低下します。SaaSのリーダーにとって、製品分析の成功には完全なUXコントロールが不可欠になります。

最後に、顧客はインテリジェンスを期待しています。予測的な洞察と積極的な推奨事項が当たり前になりつつあります。AI を活用した分析は、ユーザーが問題がエスカレートする前に行動できるように支援し、ダッシュボードを意思決定エンジンに変えます。

需要は明らかです。2025年には、データ分析ユーザーの81%が組み込み分析に依存しています。この採用は、ユーザーの期待がすでに最新の製品分析のベースライン要件であることを証明しています。

これらの期待に応えるために、企業は機能を収益への影響に結び付ける機能を必要としています。

分析からの収益を可能にする主な機能

期待に応えるには、適切な機能が必要です。適切なスタックにより、製品分析はオーバーヘッドではなく明確な収益に変わります。

SDK ファースト埋め込み

SDK は、分析をコードベースに統合します。iFrame や外部ポータルを回避します。

- 収益レバー:リリースサイクルが速くなると、収益化される機能の余地が生まれます。開発負荷が低いほど、マージンが向上します。

- 必要な証拠: 42%が採用の最大のハードルとして技術リソースを挙げています。SDKファーストの設計は、その負担を軽減します。

完全なホワイトラベリングとブランド管理

ホワイトラベル分析と完全なブランディングにより、知覚価値が促進されます。ダッシュボードは、UI と戦うのではなく、UI を補完する必要があります。

- 収益レバー:プレミアム層はより高い価格を正当化します。企業のバイヤーは、完全なブランド管理を期待しています。

- 採用効果:ネイティブのルックアンドフィールにより、使用量と更新が促進されます。

拡張可能な API とコンポーネント制御

API は、イベント、状態、レイアウト オプションを公開する必要があります。チームにはガードレールと自由が必要です。

- 収益レバー:ロールベースの機能はアドオンになります。エンタープライズ取引にはカスタム動作が必要です。

- 運用上の影響:カスタムコードが少ないため、メンテナンスコストが削減されます。

複数のデータソースへの信頼できる接続

顧客は、関連するすべてのデータを 1 か所で確認する必要があります。信頼は、報道と新鮮さに続きます。したがって、分析ソリューションは複数のデータソースを統合する必要があります。

- 収益レバー:より多くの接続されたシステムにより、ユースケースとアップセルが拡大します。

- 必要な証拠: リーダーの47%が、システム間の統合を最大の課題として挙げています。

パフォーマンス、セキュリティ、ガバナンス

速度、RLS、テナントの分離により、エクスペリエンスとビジネスが保護されます。

- 収益レバー:エンタープライズの準備により、大規模な契約を固定できるようになります。コンプライアンスにより、規制されたセクターが解放されます。

- 採用効果:高速クエリにより、ユーザーは製品に留まります。

オーサリングとセルフサービス作成

ユーザーは、チケットなしでダッシュボードを構築して調整する必要があります。

- 収益レバー:セルフサービスでは、階層化されたアクセス許可とシートの拡張がサポートされます。

- チームへの影響:バックログのリクエストが減り、ロードマップ作業により多くの時間を費やすことができます。

インテリジェンスとプロアクティブな洞察

予測と異常検出により、製品分析の価値が高まります。

- 収益レバー:高度な機能は、階層のアップグレードと接続レートをサポートします。

- 粘粘:プロアクティブなアラートにより、日々の信頼度と維持率が向上します。

予期せぬことなく拡張できる容量

成長によってコストモデルやパフォーマンスが損なわれるべきではありません。

- 収益レバー:予測可能なコストは、使用量の増加に応じて利益率を保護します。

- 証明ポイント:拡張が停滞しないように、スケーラブルな分析を計画します。

これらの機能により、組み込み分析が、顧客が料金を支払うサービスとしての分析に変わります。また、階層、アドオン、データ駆動型製品のより多くのチームへの拡張を通じて、洞察の収益化もサポートしています。機能はメカニズムを説明します。戦略は、ビジネスへの大きな影響を説明しています。

組み込み型分析ツールが効果的な収益源である理由

従来のBIツールは、顧客向けの収益化ではなく、内部レポート用に設計されていました。彼らはユーザーを別々のポータルに強制し、iFrameに依存し、大規模なITサポートを要求します。このモデルは配信を遅らせ、採用を弱めます。レガシーと最新の組み込み分析の対比は明らかです。最新のアプローチは製品に直接組み込まれ、顧客の成長に合わせて拡張し、収益への新しい道を開きます。

ビジネスケースは強力です。組み込み分析はワークフロー内に存在し、導入を促進し、ユーザーの関心を維持します。そのため、リテンションのための最も効果的な手段の 1 つになります。現在、多くの SaaS 企業は、製品分析をサポート機能ではなく、価格戦略の不可欠な部分と見なしています。これは、エンタープライズBIと組み込み分析が製品リーダーにとって決定的な選択である理由を説明しています。

アビオンの経験は、実際にその影響を示しています。SDK ファーストの分析プラットフォームを採用することで、エンジニアリング作業を 12 か月削減しました。これらの時間の節約により、機能をより迅速に提供し、コア製品の改善のためのリソースを解放できます。さらに重要なことは、顧客がブランド化されたセルフサービスダッシュボードにすぐにアクセスできるようになったことです。その結果、採用率が向上し、解約リスクが低くなり、成長に向けて製品が配置されました。

市場データがこれを裏付けています。2024 年には、テクノロジー リーダーの 81%が BI と組み込み分析への関心の高まりを観察しました。アナリストはまた、2026 年までに80%のソフトウェア ベンダーが自社製品に生成 AI を組み込むと予測しています。これらの傾向は、分析がもはやバックオフィスのレポートに限定されないことを裏付けています。これは、最新のデータ駆動型製品のビジネスモデルを形作る機能です。

見返りは直接的および間接的な収益です。プレミアム機能とアドオンはARRを生成し、組み込み分析による顧客維持は生涯価値を延長します。SaaS リーダーにとって、これは製品分析が単なるダッシュボード以上のものである理由を証明しています。それは収益の原動力です。顧客にとって、製品分析はロイヤルティを強化する具体的な価値を生み出します。

組み込み分析は、収益源としての価値を証明しています。次の質問は、ロードマップを遅らせることなく、どのプラットフォームがこれらの成果を提供できるかということです。

Revealが製品としての分析を可能にする方法

分析を収益に変えるには、IT だけでなく製品チーム向けに構築されたプラットフォームが必要です。Revealにより、SaaS リーダーは製品分析を製品機能として扱い、収益化、維持、拡張をサポートできます。

Reveal価値を提供する方法は次のとおりです。

- SDKファーストの統合

Revealはコードベースにネイティブに埋め込まれます。iFrameもポータルもありません。これにより、UXとパフォーマンスを完全に制御できます。市場投入までの時間が短縮されるということは、収益化可能な新しい機能がより早く顧客に届くことを意味します。

- ホワイトラベル管理

ホワイトラベル分析を使用すると、すべてのダッシュボードとグラフがブランドに一致します。エンタープライズのお客様は、このレベルの洗練を期待しており、プレミアム層の価格設定をサポートしています。

- 複数のデータソースへの接続

Revealは、幅広いデータソースと統合されています。つまり、顧客は全体像を 1 か所で確認できるため、インサイトを信頼できます。信頼は採用と維持を促進します。

- 予測可能でスケーラブルな価格設定

Revealユーザーごとの料金を回避できます。フラットで透明性の高い価格設定とは、分析がコストではなく製品に合わせて拡張されることを意味します。これにより、健全なマージンがサポートされ、分析をサービスとしてパッケージ化できます。

- 実証済みのイネーブルメント

開発者ツールで30+年にわたり、Revealサポート、ドキュメント、専門知識を提供し、チームがロードマップを遅らせることなく分析を提供できるように支援します。

これらの強みにより、SaaSプロバイダーは真のデータ駆動型製品を設計できます。分析は後回しにされるのではなく、収益を生み出し、顧客ロイヤルティを強化するコア機能になります。

関連記事

ブログに戻る

ブログに戻る